Scaling up adaptation finance — UNFCCC in-session Workshop on Long-term Finance

Felix Fallasch

Share

The annual “In-session Workshop on Long-term Finance” was held on 4-5 June 2015, during the Bonn Climate Change Conference. It aimed to explore opportunities for scaled up and enhanced action on adaptation finance and feed discussions into the broader process of scaling up climate finance.

Negotiators, representatives of UNFCCC bodies, government agencies, NGOs and think tanks worked together to generate concrete ideas about how to spur private sector involvement in adaptation, and the respective and strategic roles of the private sector, public sector, adaptation projects and policy frameworks in creating enabling environments in developing countries.

Thematic bodies of the UNFCCC (Adaptation Committee, LDC Expert Group, Standing Committee on Finance, Technology Executive Committee) and representatives of the private sector, including from insurance schemes initiatives presented on practical ways to mobilize finance to foster adaptation actions in developing countries. Workshop participants discussed two topics: the role of collaborative arrangements for managing climate risks; and strengthening institutions’ capacity to access climate finance.

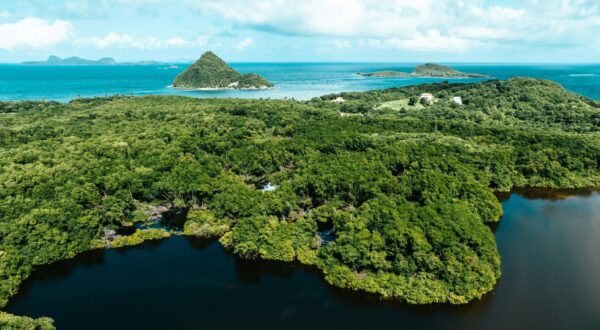

Climate Analytics’ Laetitia De Marez, who facilitated a group on collaborative arrangements for managing climate risks, discussed the advantages and disadvantages of financing instruments including insurances based on whether they addressed climate risk or broader factors. She noted the need for broad and continuous resilience building strategies in areas of high vulnerability as a basis to build upon for insurance mechanisms. She discussed with participants the necessary region specific and country-tailored nature of those mechanisms, highlighting in particular the case of SIDS and LDCs. Participants also looked into barriers and opportunities for capacity- constrained countries in setting up climate risk management schemes and agreed that two essential first steps include seeds money from donors and establishing robust climatic data collection and management systems.

De Marez also debated the UNFCCC’s role in: catalyzing adaptation finance; implementing new sources for adaptation; connecting actors from various sectors; and engaging in outreach including via interventions by the Standing Committee on Finance members at business meetings.

‘Adaptation measures and mechanisms have to be tailored to vulnerable countries and affected communities’ real needs,’ De Marez said. ‘The private sector has an important role to play but we also need to be realistic about the near term potential where grant based public finance is crucial to meet the immediate and urgent needs of the most vulnerable. Dialogues between actor such as the one I had the opportunity to moderate are very encouraging to highlight where needs and opportunities can meet to build private sector partnerships that can foster climate compatible sustainable development.’