Science based coal phase-out timeline for Japan - Implications for policymakers and investors

Authors

Paola Yanguas Parra, Yuri Okubo, Niklas Roming, Ursula Fuentes Hutfilter, Fabio Sferra, Michiel Schaeffer, Bill Hare, Matt Beer

Share

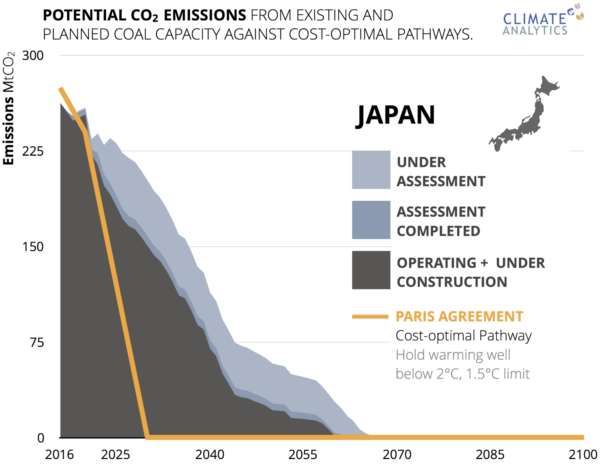

This report evaluates whether Japan’s energy policies and long-term targets are compatible with meeting the objectives of the Paris Agreement, and what this means for policymaking and investors. Achieving the Paris Agreement temperature goal requires rapid decarbonisation of the power sector, yet Japan is heading in the opposite direction with plans and financing set to increase carbon intense coal-fired power capacity. Current policies and plans would result in carbon pollution between now and 2050 almost three times what is consistent with the Paris Agreement, risking stranded assets and loss of competitiveness for Japanese investors. Policymakers need to revise national targets and policies in order begin a smooth transition to a low-carbon future.

Japan’s current coal-fired power policies and plans would result in carbon pollution between now and 2050 almost three times what is consistent with the Paris Agreement, risking stranded assets and loss of competitiveness for Japanese investors, says a new report by Climate Analytics, in collaboration with the Renewable Energy Institute of Japan.

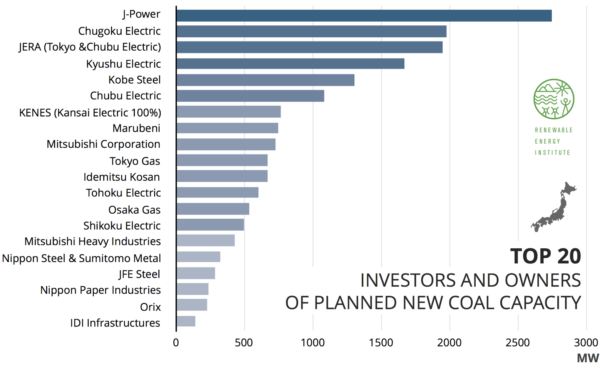

Unlike most developed countries, Japan plans to increase its coal-fired power capacity, and its banks are financing coal developments in other countries, especially in South East Asia, in contradiction of the deep emissions reductions required to curb climate change.

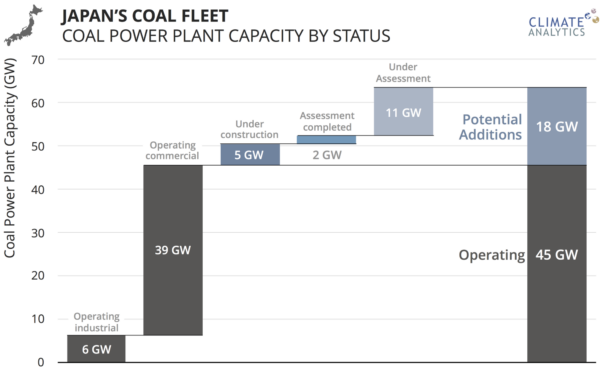

Japan already has 45 Gigawatts of operating coal-fired generation capacity and plans to add about 18GW of new coal, of which 5GW are already under construction.

The report evaluates whether Japan’s energy policies and long-term targets are compatible with meeting the objectives of the Paris Agreement, and what this means for policymaking and investors.

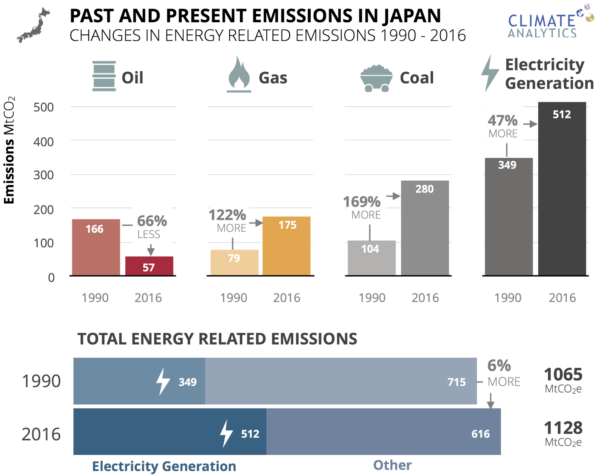

In Japan – the sixth largest global greenhouse gas emitter – electricity generation is responsible for around 40% of its GHG emissions. In 2016, more than half of these came from coal (about 20% of total emissions), making it a major contributor to climate change.

“To be in line with the Paris Agreement, developed countries need to phase out coal from their energy systems by 2030, yet Japan appears to be going in the opposite direction,” says lead author Paola Yanguas Parra from Climate Analytics.

“If Japan’s emissions trajectory from its current energy and investment plans for coal were to continue, it would overshoot its Paris Agreement emissions budget for coal in the electricity sector by 292% by 2050. It’s clear from our analysis that Japan’s primary focus for achieving its national commitments – and the Paris Agreement goals – should be to urgently address emissions from coal.”

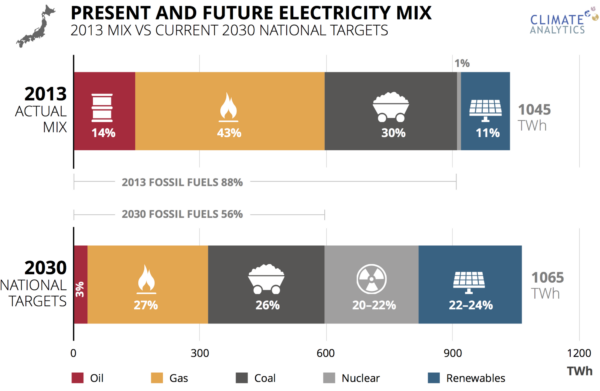

Japan’s Paris pledge is inadequate in meeting the Paris Agreement goals, foreseeing a 26% share of coal but only a 22-24% share of renewables by 2030. It also includes a 20-22% share of nuclear, which has been challenged by other studies that suggest a more realistic share is a maximum of 10%.

“The Fukushima disaster revealed that Japan’s climate policy to rely on nuclear power was a failure – nor will efficiency standards for coal bring the necessary emissions reductions. Japan needs a much higher renewable energy target, and increasing numbers of companies are demanding renewable energy,” said Yuri Okubo, of the Renewable Energy Institute.

“Policymakers need to revise national targets and policies to be consistent with international and national commitments, and introduce measures – such as carbon pricing – to offer the right incentives to choose renewables over new coal, and phasing out operating coal plants,” co-author Dr Ursula Fuentes Hutfilter from Climate Analytics.

Recent cases of investors withdrawing from coal projects in Japan highlight the risks of stranded assets and difficulty in recouping investments. Many Japanese businesses and investors also face financial risks as the world’s major insurance companies, like AXA and Allianz, begin to divest from companies with coal interests. As international companies, like Apple, commit to 100% renewable targets, suppliers are increasingly coming under pressure to procure renewable energy and reduce emissions.

“Prices of renewables are dropping quickly and will reach parity with coal between 2020-2030, and solar photovoltaics will be cheaper than gas in less than five years in Japan, even before considering a carbon price,” says Bill Hare, CEO of Climate Analytics.

“A clear policy signal and a structured phase-out plan will benefit Japan and ensure that coal-related businesses, workers, owners and investors make a sound transition to a low-carbon future.”