High and dry: the global energy transition's looming impact on the LNG and oil shipbuilding industry

Authors

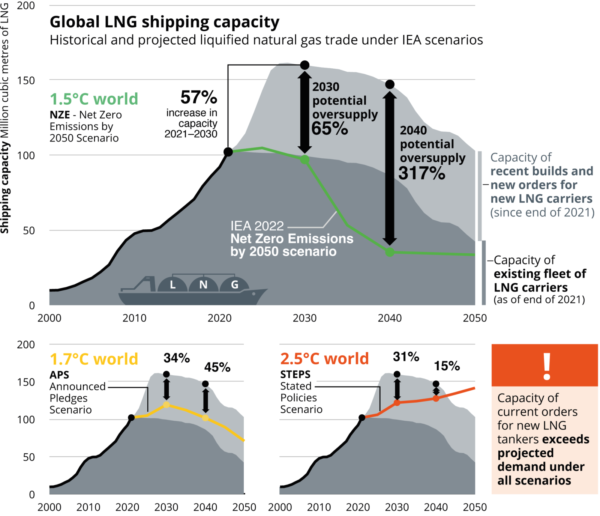

Shipbuilders lured by a temporary bull market will likely be left stranded as the world transitions away from fossil fuels. They are facing significant risk by overshooting liquefied natural gas (LNG) shipping capacity that is inconsistent with future energy scenarios.

This report finds that the uptake in shipping capacity far exceeds global forecasts of LNG trade as the world transitions away from fossil fuels to limit global warming to 1.5°C, and that the LNG shipbuilding business could become stranded under the International Energy Agency (IEA)’s net-zero scenario.

In 2022, 34 LNG carriers were added to the global fleet, and 335 LNG carriers are expected to be added between 2023 and 2028, according to data from Clarkson Research. This surge in orders was largely driven by the oil and gas industry’s dash for LNG following Russia’s invasion of Ukraine.

However, under growing pressure to decarbonise, governments around the world have announced pledges and adopted policies that would render much of the new LNG vessels useless.

The findings are especially relevant to South Korea, which dominates the global LNG shipbuilding industry. In 2022, Korean shipbuilders won over 70 percent of LNG carrier vessel orders.

In the 2010s, Korean shipbuilders faced major financial challenges after oil prices slumped following the recession, and vessel owners began pulling out of contracts or delaying delivery and payment of drillships and offshore oil and gas production facilities.

Despite the high stranded asset risk of LNG carriers, South Korean shipbuilders are looking at a wave of new building orders from oil and gas companies that are doubling down on their fossil fuel business. Currently, QatarEnergy and South Korean shipbuilders are discussing an order of up to 40 new LNG carriers for delivery in 2027.

The French oil and gas major TotalEnergies is also resuming the highly controversial Mozambique LNG project, which was halted in 2021 due to escalating conflicts in the region. The company and Korean shipbuilders are looking to sign contracts for an order of 17 LNG carriers in July.

If built, the global LNG shipping capacity will further exceed IEA’s forecast of LNG trade. This poses particular risk for financial institutions that provide loans and underwriting to the capital-intensive shipbuilding industry.

Between 2011 and 2020, South Korean public financiers provided a total of USD 127 billion to the oil and gas industry. Of this, 46 percent went towards the construction of oil and gas-related shipbuilding – including offshore oil and gas production facilities and LNG carriers.