Active

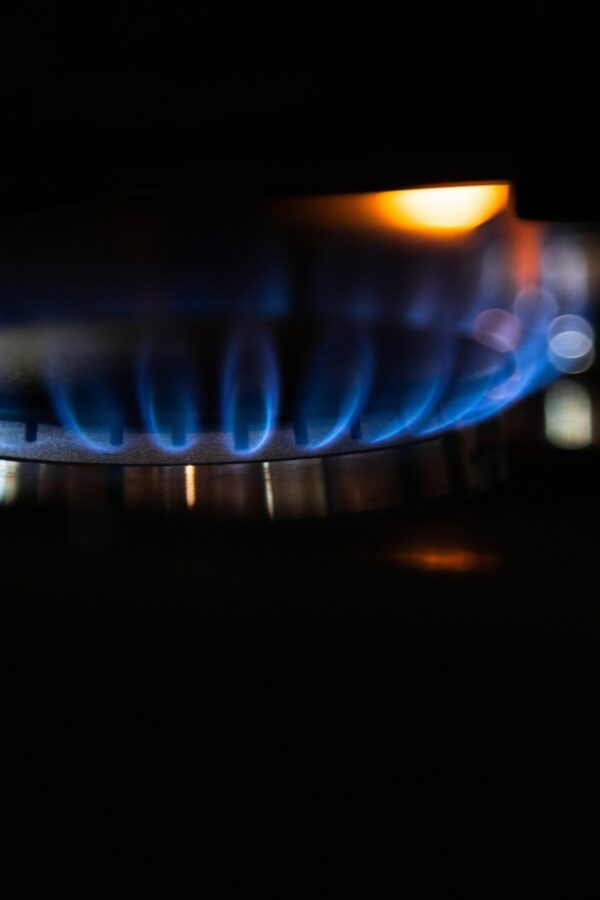

Fossil gas has long been marketed as a “bridge fuel” on the way to a cleaner energy system – a less-polluting alternative to coal. But this is a dangerous fallacy promoted by vested interests. Gas is not a clean energy source.

Between 2010 and 2019, gas was the largest source of the increase in CO2 emissions (42%). It’s also responsible for the largest share of methane emissions from fossil fuel production – which is an incredibly potent, but short-lived greenhouse gas that accounts for a substantial amount of warming to date.

In its 1.5°C aligned net zero scenario, the International Energy Agency has shown that no new oil and gas fields can be developed.

Our work

Since 2017 we’ve been analysing and communicating the risks of gas investment and reliance – both from a climate and economic perspective. Our work spans the global, regional and national level – as well as focusing on specific production projects.

We’ve been involved with the first United Nation’s Production Gap Report, and like our work on coal, we have been a first mover on providing a clear picture of what international climate targets mean for gas production and consumption.

Key 1.5°C-aligned phase-out dates for gas

- Fossil gas power generation needs to be almost completely phased out by 2040.

- This phase-out needs to be front-loaded. In 1.5°C compatible pathways, fossil gas use falls to 5-7% of total global electricity generation by 2030.

- In developed countries, gas phase-out in electricity generation will need to be accelerated. It needs to fall to very low levels (<5% by 2030) to be effectively phased out by 2035 – five years after coal.

- In developing countries, the share of gas in power generation remains low and falls towards zero by 2040 in most countries. A rapid fossil gas exit in many developing countries will require financial, technical and, depending on the circumstances, transitional support from developed countries.

Fossil gas phase-out occurs at most 5-10 years after the coal phase-out date in both developed and developing economies. So we see it cannot play a role as a transition fuel in the power sector.

This, paired with the dramatic plummet in the cost of renewable energy, means investing in new fossil gas power generation in the 2020s carries the risk of creating stranded assets.