Gas is casting a long shadow over green development in Africa

Despite having 60% of the world’s solar resources the continent has less than 2% of the world’s investment in renewable energy. At COP27, there were calls to expand African gas, risking locking in high emissions, burdening their economies with stranded assets, and potentially losing out on major economic opportunities to invest in renewable energy and green hydrogen.

Share

Africans know we are vulnerable to climate change, because many still intrinsically depend on the land for their livelihoods. And we can feel the climate shocks: drought in the Horn of Africa. Flooding in Nigeria. Cyclones in Madagascar.

We are already dealing with reduced food production, reduced economic growth, increased inequality and poverty, increased human morbidity and mortality and major biodiversity loss – all of which will intensify and compound as temperatures creep higher.

Limiting global warming to 1.5C is fundamental for development, with clear economic benefits from a low emissions pathway emerging for Africa by 2030. The International Renewable Energy Agency (Irena) calculates that compared to current plans, a path to 1.5C would deliver an additional 6.4% in GDP growth by 2050, 3.5% more jobs and a 25.4% higher welfare index.

But in the current energy crisis, lobbyists, companies and governments are pushing another option: gas.

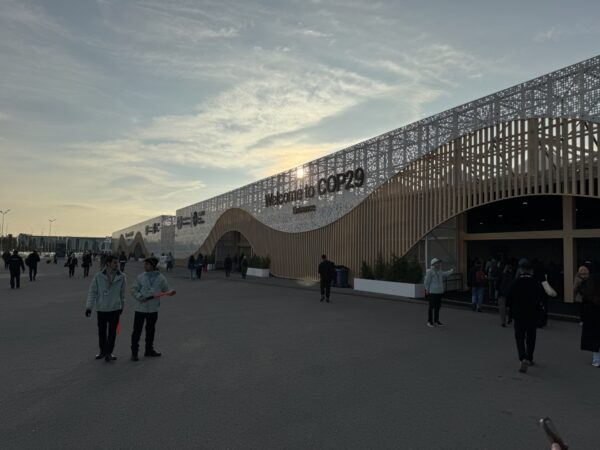

At Cop27, a significant minority of delegates are seeking gas deals, with development as the moral justification. The reality is African governments taking on outrageous debt to subsidise companies from the global north coming to turn a profit, while local people bear the brunt.

White elephants

If African countries invest in fossil fuel infrastructure, it risks locking in high emissions, burdening their economies with stranded assets, and potentially losing out on major economic opportunities to invest in renewable energy and green hydrogen – for both domestic use and exports.

Most revenues generated from fossil fuel projects go to multinational companies, not the countries where they’re generated. In Nigeria, Africa’s biggest oil producer, 55 million people are still without access to electricity: it has the most people in extreme poverty in the world.

Another example is Mozambique, where the government has taken on debt in advance of promised future tax revenue from LNG development.

This can exacerbate developing countries’ debt burdens, worsen poverty and increase dependency on international aid.

A study by McKinsey shows African gas and oil fields are 15-20% more expensive to develop and up to 80% more carbon-intensive than other fields globally. New African LNG faces significant competitive pressures if not disadvantages from incumbent producers, or producers with intrinsically lower cost structures.

LNG manufacturers want to take advantage of high global prices for their product, creating serious difficulties for domestic access to cheap gas.

Is there room for more gas? The International Energy Agency’s (IEA) 1.5C-compatible Net Zero Roadmap projects that African LNG exports would have to peak by 2025 and begin dropping to low levels by 2030.

In this scenario, total African gas production would also need to peak by around 2025 and drop below 2010 levels by the mid 2030s. Importantly, the IEA scenario has significantly higher gas than many other Paris compatible pathways through the 2030s: it’s clear that if the world implements the Paris Agreement the prospects for ongoing markets for new gas from Africa aren’t great.

Barriers to clean development

To achieve sustainable development goals, Sub-Saharan Africa needs stronger investment in renewables. Irena shows the region, accounting for about 14% of the global population, received only around 1.7% of global investment in renewable energy 2010 to 2020.

The IEA says 60% of energy investment in Africa still went to fossil fuels in 2021, with total annual energy investment around $90 billion.

High perceived risks of renewable energy investments mean investors require a higher rate of return. Projects face high financing costs, limited availability of long-term financing, lack of institutional knowledge and must compete with heavily subsidised fossil fuel consumption and production in many countries.

The average annual investment fossil fuels in Africa in recent years is around $33 billion a year and in $5 billion in renewables. In other words, annual fossil fuel investment is 6-7 times greater than in renewables.

The paradox? Renewables are already cheaper than coal and gas power plants in most African countries, but they’ve not received promised climate finance required to fund the energy transition – while international support for fossil fuels continues.

Energy access and supply in Africa is not a black and white, either/or decision-making environment – but Africans are not here to be taken advantage of to further subsidise the consumption habits of the north.

This model is all too familiar to us. If developed countries are serious about supporting sustainable development in Africa, they must prioritise support for climate-resilient infrastructure and generation.

This article was originally published in Climate Home News.

Header image: Women sell fufu at market in Abuja, Nigeria. ©IFPRI/Milo Mitchell, Flickr (CC BY-NC-ND 2.0 DEED)