Submission to the Australian Treasury consultation on the Petroleum Resource Rent Tax

Authors

Share

In this submission, Climate Analytics recommends the Australian Federal Government reforms the Petroleum Resource Rent Tax (PRRT) – anti-avoidance provisions and clarifying treatment of ‘exploration’ and Mining, Quarrying or Prospecting Rights (MQPRs) to align with its climate commitments.

The PRRT is not fit for purpose as a tax on the gas industry

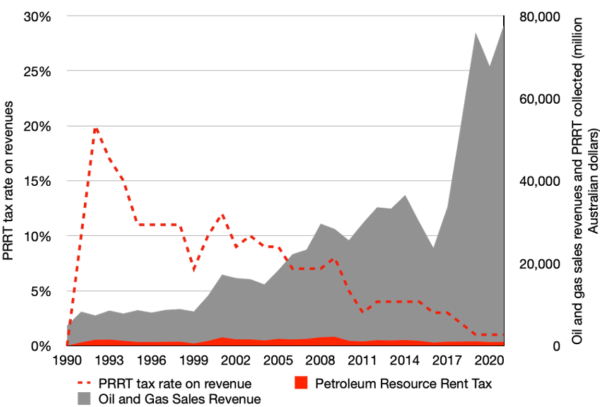

The Australian Energy Producers, formerly known as the Australian Petroleum Production and Exploration Association (APPEA), provides oil and gas industry financial surveys that include revenues, taxes and charges. Their data show that, while the industry has experienced a sustained growth in revenues, incomes from the PRRT have remained steady. The effective amount of PRRT collected as share of revenues has collapsed.

The divergence between revenues collected by the Australian Government from oil and gas producers on one hand, and their profits on the other hand, coincides with the shift from petroleum to gas production, allowed by the AUD 300 billion investment in the gas sector.

The shift from petroleum to gas has had deep consequences on the revenues collected from the PRRT, owing to the structure of the rent tax. Previous reviews of the PRRT and the associated gas transfer pricing rules have shown that the rent tax is not as effective for gas as it is for oil production. As presented in the first 2023-24 Budget paper:

“LNG projects are highly capital intensive and, compared to oil projects, generally take much longer to become cash flow positive after commencing production. This impacts the PRRT collected from LNG projects, particularly where projects have very large carry-forward deductions that are uplifted for many years.”

These massive, sudden capital inflows explain why, “to date, not a single LNG project has paid any PRRT, and many are not expected to pay significant amounts of PRRT until the 2030s”.

A more effective PRRT can contribute to the financial efforts necessary for the clean energy transition

The funds that could have been raised through a higher and more efficient Petroleum Resource Rent Tax could have been allocated to the clean energy transition, redirecting revenue streams from harmful activities to sectors with positive externalities.

As a comparison, if Australia had taxed its oil and gas industry at the same rate as Norway did theirs over the period 2011 - 2020, the Australian Government would have received over four times as much revenue.

The PRRT still holds significant potential to contribute to the transition towards cleaner energy sources. Reforming and increasing its revenues present an opportunity to better align Federal Government financial flows with Australia's international commitments.

At COP28, Australia signed the final text of the Global Stocktake, with the commitment of “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050 in keeping with the science”. This evolving context will affect the revenues the PRRT can levy from gas projects.

To guarantee adequate revenue streams from the PRRT despite declining production, prompt implementation of an effective reform is necessary to capitalise on current levels of LNG exports while minimising the uncertainties related to the longer-terms, declining outlook pathways for gas production.

In this environment, the tax exemption for new liquefied natural gas projects - which may end up as stranded assets - until their seventh year of production, represents a missed opportunity to generate public funds, at odds with the government’s own call to act now.