Carbon majors’ trillion dollar damages

Authors

Carl-Friedrich Schleussner, Marina Andrijevic, Jarmo Kikstra, Richard Heede, Joeri Rogelj, Holly Simpkin, and Sylvia Schmidt

In 2022 Aramco announced what its CEO called “probably the highest net income ever recorded in the corporate world.”

Supply disruptions resulting from the illegal invasion of Ukraine by Russia - the largest gas supplier to Europe - led to huge spikes in price for gas, which then bled into demand for other fossil fuels, tightening energy markets around the world and pushing up prices for goods across supply chains.

Meanwhile, unprecedented disasters fuelled by climate change made the case for a robust funding mechanism for loss and damage more pressing. The 2022 United Nations’ climate conference saw a breakthrough, with the agreement to establish both a new fund for loss and damage and new funding arrangements.

In this report we explore who could pay for loss and damage through the lens of responsibility for historic emissions, and the financial gains generated from selling oil and gas.

We use a well-established methodology - the social cost of carbon - to calculate damage estimates from the 25 biggest emitting oil and gas companies in the world from 1985 to 2018, and compare it with the financial gains made over the same period. We look at Scopes 1, 2 and 3 emissions in our estimate of the total damages resulting from emissions attributable to fossil fuel companies.

To account for the potential responsibility of other actors such as consumers and policymakers, we also explore an established approach that uses a clean third split between producers, emitters and policymakers. We refer to this as partial damage allocation.

Between 1985 and 2018, we estimate partial damages of the combined CO2 emissions from 25 companies - oil and gas carbon majors - of about 20 trillion USD. Over the same time period, their financial gains were about 50% larger - roughly 30 trillion USD.

Carbon majors could have paid for their damages and still made 10 trillion USD.

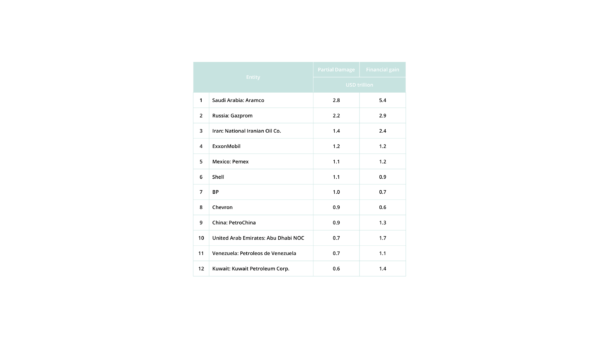

The dirtiest dozen

The dirtiest dozen of the carbon majors account for about 15 trillion USD in damages and 21 trillion USD in gains.

Saudi Arabia, Russia, Iran, China and the United Arab Emirates are home to the largest state-owned carbon majors with both the largest financial gains and damages incurred. Of the private companies, ExxonMobil, Shell, BP, Chevron and TotalEnergies were responsible for the highest damages and saw the biggest financial gains.

For a subset of seven carbon majors including Aramco, Exxon Mobil, and Shell, we provide estimates for 2022. These seven carbon majors together amassed 497 billion USD in financial gains in 2022 compared to 260 billion USD in partial damage estimates. In other words, financial gains were almost twice the estimated partial damages.

Self-perpetuating fossil wealth

Several countries channel parts of their fossil fuel gains into some of the biggest sovereign wealth funds world-wide. The sheer size of the funds, and their returns, points to the persistence of fossil-accumulated wealth well beyond extraction.

The United Arab Emirates is home to the biggest combined sovereign wealth funds in the world. Half of its funds could pay for the damages associated with its oil and gas industry, and it would still have 700 billion USD in wealth.

The United Nations Secretary General and leaders of vulnerable countries have called for the use of windfall taxes to redistribute huge profits from carbon majors (which look set to continue) for loss and damage funding. Governments that are home to these carbon majors, or perhaps the companies themselves, could well be called on to contribute to a loss and damage fund. It’s clear they are good for it.