Tripling renewables by 2030: interpreting the global goal at the regional level

Authors

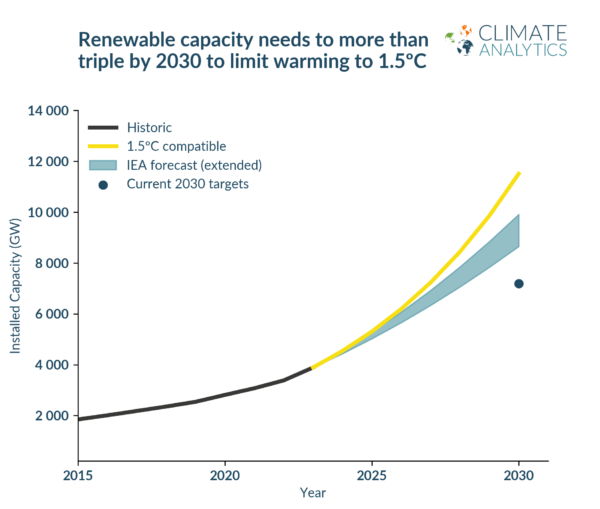

At COP28, governments agreed to triple global renewable capacity by 2030. This, alongside doubling energy efficiency, is possibly the most powerful action the world can take in the transition away from fossil fuels this critical decade.

To guide efforts towards the goal, governments need a clear roadmap and information on investment and climate finance needs, while civil society needs benchmarks to hold governments to account.

This report breaks down what a 1.5ºC-aligned renewables rollout would look like at the regional level and calculate the associated investment needs.

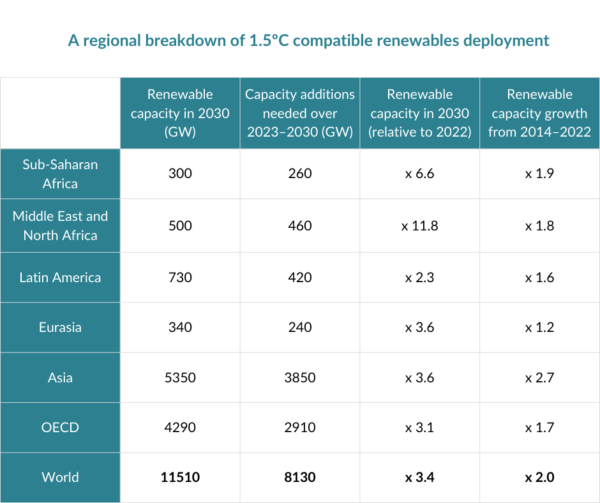

In keeping with the tripling target and the Paris Agreement’s temperature goal, global renewable capacity needs to grow to 11.5 TW by 2030 – up 3.4x from 2022 levels.

To achieve this, different regions scale at different rates relative to their current renewable capacity, driven by the pace of fossil phase-out needed and future electricity demand growth.

The report finds:

- Asia makes the biggest overall contribution, providing around half (47%) of the 8.1 TW of renewable capacity additions needed globally by 2030.

This represents a 3.6x regional growth rate relative to 2022 levels.

Asia is the only region which is broadly on track to triple renewables in line with 1.5ºC by 2030. This is primarily driven by growth in China and India which compensates for laggards like South Korea, where renewable capacity is set to grow at half the rate of the region as a whole.

However, the spree of coal-fired power plant construction in China and India is a huge concern. If this continues, it will either jeopardise a 1.5ºC-aligned power sector transition, or create large-scale stranded assets. - The OECD provides the next biggest share of global capacity additions at around a third (36%).

Renewables in the region scale at a slower rate of 3.1x due to lower electricity demand growth and a higher level of existing renewable capacity installed in 2022.

Based on current policies, the OECD will fall around a third short of this target. Addressing this shortfall would close around 60% of the 2 TW global gap between forecast renewable growth and a 1.5°C-aligned tripling. There is particularly slow growth in Japan, where capacity will grow only 50% over the decade.

- Sub-Saharan Africa scales relatively quickly at 6.6x due to low levels of existing renewable capacity and high energy access needs.

Electricity demand is forecast to grow 66% per capita between 2020-2030 in the region, resulting in a renewables scale up rate that is double the global average. Achieving such a rapid renewables rollout in Sub-Saharan Africa would require significantly upscaled international climate finance.

$12 trillion needed to triple renewables in line with 1.5°C

Overall, tripling renewables in line with the 1.5°C temperature limit would require $12 trillion of investment in the power system up until 2030 – an average of $2 trillion per year starting in 2024.

Two-thirds ($8 trillion) would be invested in the installation of renewables, while around a third ($4 trillion) would be for the grid and storage infrastructure needed to support renewables. Without modernised, flexible and expanded grids, there can be no tripling.

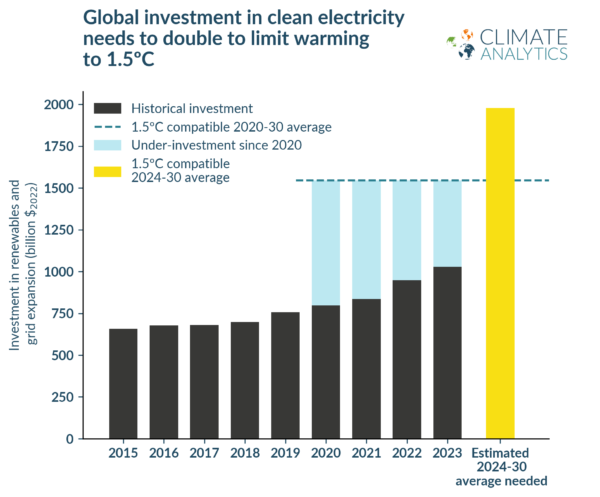

Investment in renewables and grid expansion needs to be massively upscaled to ensure a 1.5ºC aligned transition in the power sector. In 2023, global investment reached $1 trillion, around half of annual investment needed on average between 2024-2030.

Over 2024-2030, the world is on track to invest $6.6 trillion in renewables and grids, leaving an investment shortfall of just over $5 trillion. However, the world is also set to invest over $6 trillion in fossil fuels under current policies. Shifting this money to renewables and grids could cover the investment gap entirely and put the power sector on track for 1.5ºC.

Some regions are at risk of falling behind in the effort to triple renewables due to a chronic lack of investment and international support.

This is particularly the case in Sub-Saharan Africa, where annual investment in renewables and grid expansion was around $20 billion in 2023 – just a fifth of the ~$100 billion needed each year between 2024-2030.

Without an urgent and rapid increase in finance to support renewables deployment in Africa, millions will miss out on the benefits of the renewables revolution – cleaner air, cheaper power, and increased energy security.

As governments come together to negotiate a new climate finance goal for the post-2025 period, much more needs to be done to mobilise investment in renewables and grid expansion in less wealthy countries. Without this, the pledge to triple renewables made at COP28 will ring increasingly hollow.

While scaling up renewables is key, emissions will only fall if they displace fossil fuels in the power system. As well as investing in renewables, governments must take action to end public support and subsidises for fossil fuels. COP28 fired the starting gun on a global race to triple renewables by 2030. This report sets out a roadmap at the regional level to guide the way.