Credit ratings and climate risk: a financial trap for small island states

Adelle Thomas, Luis Zamarioli

Share

Climate change impacts impose substantial economic costs on society. Financing is essential for adaptation and for the immediate and long-term consequences of loss and damage. Even more, costs of addressing climate risks threaten to cripple national economies of developing countries. Although these affected countries have commonly contributed least to causing the problem of climate change, they are faced with significant financial burdens.

With increasing impacts of climate change, there is a threat that escalating financial risks will potentially erode the credit position of vulnerable developing countries, namely their ability to tap into any type of commercial capital. This includes non-climate related finance, ranging from “profitable” investments (potentially used to boost the economy and increase the country’s capability to repay future debts) to investments in public goods such as education and basic infrastructure.

The risk of climate change impacts has begun to affect the creditor position of vulnerable developing regions and countries. The slow pace of global climate action results in a well-justified fear of more extensive climate change impacts. Current mitigation efforts are on track for over 3˚C of warming, exceeding the Paris Climate Agreement’s 1.5˚C temperature limit. Already with 1˚C of global warming, vulnerable countries across the globe are experiencing severe impacts, including heavy flooding from more intense rainfall, significant damages from stronger tropical cyclones, and reduced agricultural outputs due to severe drought. At 3˚C of warming, these impacts will intensify, exceed limits of adaptation and result in significant levels of loss and damage.

This risk of increased impacts creates a strong bias against investments in developing countries that might be hit the hardest, either due to high physical exposure, such as for coastal or island countries, or due to limited adaptive capacity, stemming from low income levels or lack of resilient social structures. The lack of detailed and reliable statistical data needed for accurate climate models also add to the uncertainty about the future of lower income countries, helping to increase their financial risks.

Climate change risk is compounded objectively on top of biases that already exist against lower income countries. These countries are often perceived by the financial market as much riskier due to a myriad of non-climatic reasons, such as political instability, low institutional capability, risks of nationalisation and expropriation, among others.

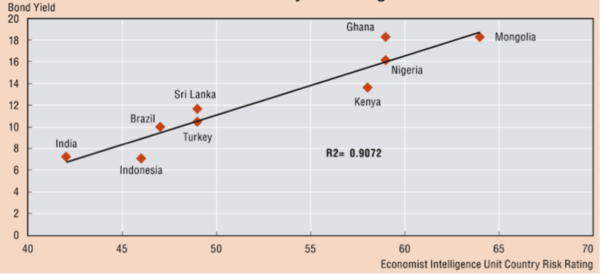

Credit rating agencies translate different risks into single and comparable sovereign credit grades or risk profiles. Different grades indicate different levels of attractiveness to foreign investment, or “creditworthiness”. They also reflect on the accessibility to new capital and how much capital will cost for a specific country or project within its territory. Figure 1 shows the strong correlation between sovereign credit grade and the price paid for bonds issued by different countries.

Credit rating agencies have all broadly expressed the need to refine how climate risks are incorporated into sovereign risk profiles. In 2016, Moody’s was the first of the three big credit rating agencies to go a step further and indicate that US cities and regions most exposed to climate impacts should present investors with mitigation and adaptation strategies that justify their maintenance on the same risk threshold.

Without such strategies, these areas would see their credit rating downgraded. In other words, high-risk US coastal communities must show progress on reducing climate impacts, hence reducing financial risks and protecting investors’ interests. Otherwise, capital for these cities will become more difficult to access and more expensive due to higher interest rates.

In the same year, another warning was issued by Moody’s, signalling the inclusion of climate risk consideration to the credit profileof small island States. Moody’s assessed that small islands could have GDP levels 4% lower by 2030 compared to a world with no climate change, impacting these countries’ economy as a whole. For example, Fiji’s recent credit profile was determined by not only assessing existing debt and political stability, but also by including vulnerability to “both, sudden climate events and gradual climate change trends”.

Many small islands are already rated below investment grade by Moody’s, making it difficult to maintain and attract new investments. Prospects that island States’ sovereign ratings might be downgraded over time due to climate risks and impacts put these countries in a type of “financial trap”, leading to challenges in managing national finances, dependence on foreign aid and increased vulnerabilities to climate change.

As they are considered highly vulnerable to impacts of climate change, island States have a particular need to access finance in order to adapt, insure and build a buffer for potential loss and damage. At the same time, as observational and model data continue to provide evidence for the translation of physical impacts into objective financial risks, the credit position of these island States may start to erode internationally, making access to any new capital for development or climate adaptation needs both scarcer and costlier.

With less access to capital markets, the capacity to adapt diminishes over time and impacts increase, making both climate and financial risks higher and capital even costlier in the long-run. In the end, islands are trapped into a downward spiral, where their economic prospects are dampened by climate impacts while their ability to access international finance on their own will be increasingly eroded. They become not only financially dependent and with a growing level of indebtedness, but also potentially less able to build the necessary adaptive capacity or to access capital for rebuilding after extensive impacts. In terms of impact on poverty eradication and human development more generally, this severely threatens to revert the progress made in the last years or decades in many developing countries.

The clear goal of the Paris Agreement to limit temperature rise to 1.5˚C sends an important message about political engagement, with effects on the perception of where we as society expect to be in the next decades. Limiting warming to 1.5°C would significantly reduce climatic risks, thus reducing the chances of sentencing vulnerable developing countries to a financial trap that will not only decrease their financial ability to adapt, but may be detrimental to national economic sustainability in the medium to long term.

These vulnerable developing countries will be the ones to carry the financial burden for increased risks from climate change. Even though many demonstrate exemplary ambition in their climate plans, their tiny carbon footprint means that they alone cannot put the world on a pathway to stay below 1.5˚C. Each cent invested in carbon-intensive activities that pushes us further from staying below the 1.5˚C limit should carry another cent for supporting not just adaptation and loss and damage, but also to counter the financial consequences that the lack of urgency in dealing with climate change imposes on the most vulnerable.