Japan at an international crossroads - seeking a sunset for coal

Authors

Matthew Webb, Paola Yanguas Parra

Share

Japanese promotion of coal is in conflict with Paris

The debate around Japan’s addiction to coal has further intensified following the launch in Tokyo in May 2018 of the report Science Based Coal Phase-out Timeline for Japan – Implications for policy makers and investors produced by Climate Analytics with the collaboration of the Renewable Energy Institute of Japan (REI).

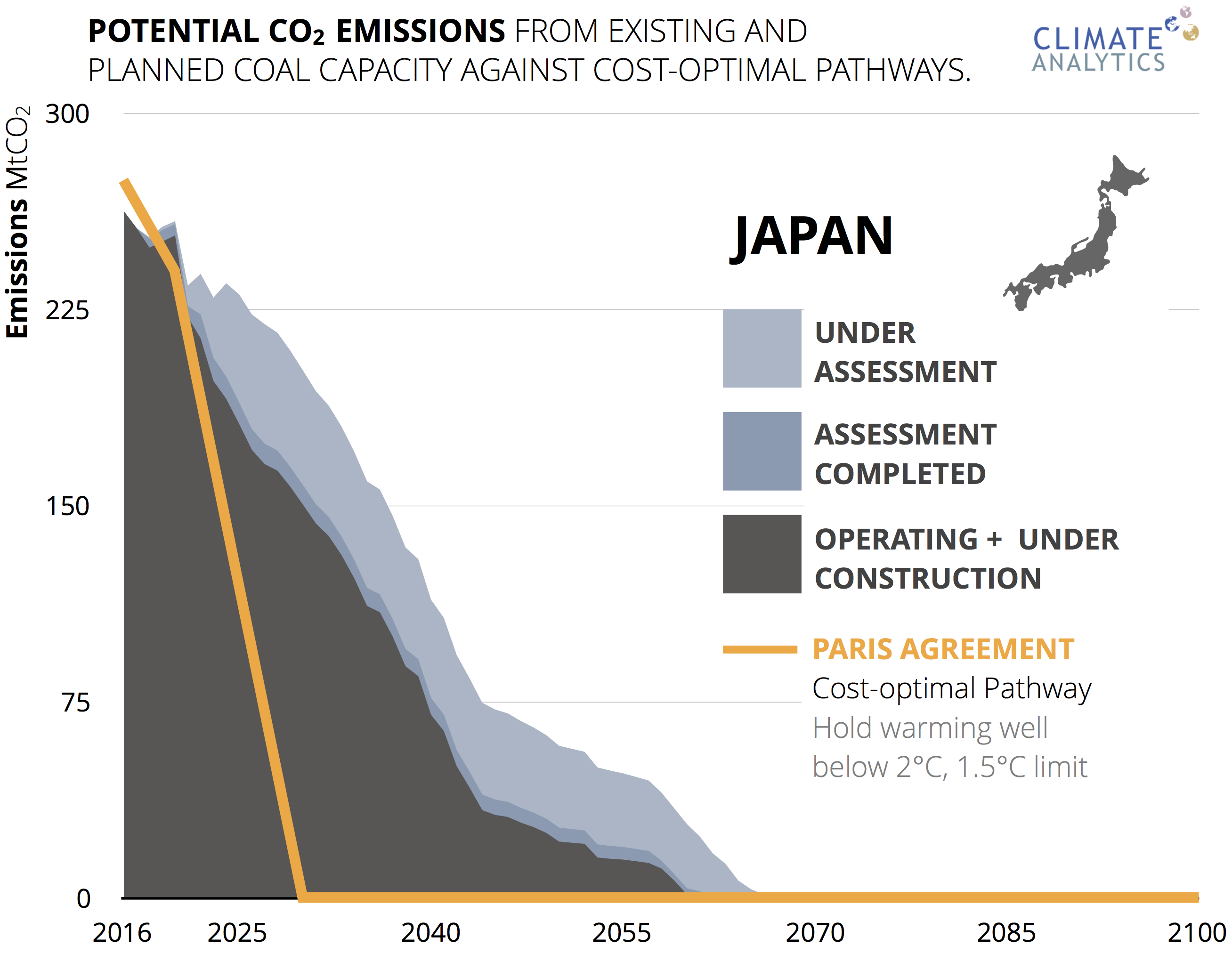

The report finds that Japan’s current policies and plans for new coal-fired power generation would result in levels of carbon pollution almost three times what is consistent with the Paris Agreement between now and 2050. This would create a significant risk of stranded assets and loss of competitiveness for Japanese investors.

Further, the analysis shows that Japan will need to implement early retirement of currently operating plant and / or dramatically reduce the number of hours that they operate in order to align with a carbon budget compatible with the Paris Agreement, as shown in Figure 1 below.

Powering Past Coal

Significantly for Japan’s international profile, the launch of the analysis included participation by representatives from the UK and Canadian governments, who outlined the steps being taken by the Powering Past Coal Alliance and its 64 partners to accelerate the global transition from coal. The Alliance launched at COP23 with the aim of bringing together governments, businesses and organizations that are ‘united in taking action to accelerate clean growth and climate protection through the rapid phase-out of traditional coal power’. The Alliance acknowledges the need to phase-out coal at the latest by 2050 globally, and by 2030 in OECD countries and the EU28, based on analysis by Climate Analytics.

The engagement of the Alliance with Japan is critically important as an offer of international support. Japan remains an outlier within the G7 as the only member still actively seeking to develop new coal power generation (with an estimated development pipeline of 18GW) and at the same time it is proactively exporting coal-fired technology overseas. Over the past three years, E3G’s G7 Coal Scorecard reports have consistently found Japan to be the worst performer across all six categories of analysis, as shown in Figure 2 above.

Japan’s Strategic Energy Plan

Japan’s powerful Ministry of Economy, Trade and Industry (METI) is currently updating Japan’s Strategic Energy Plan. The last version of the plan dates from 2014, but despite many changes in the global energy context it is widely expected that little will change in this revision. This would have serious consequences for Japan’s energy future and for the world’s climate goals.

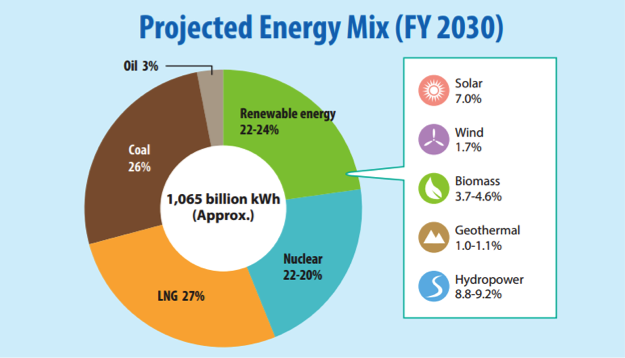

Japan stands at a crossroads internationally and these impending domestic energy policy choices will determine is direction of travel. Without a change of direction, the revised Plan risks baking in Japan’s weak renewable target of 22-24% (recently described as ‘lamentable’ by Foreign Minister Kono) and continue the pretense that Japan’s nuclear fleet will regain its former status and provide 20-22% of the energy mix, as shown in Figure 3.

Similarly, coal is predicted by METI to retain its dominance of the energy mix at 26% – a position completely at odds with all credible analyses of what is needed within OECD economies to achieve global climate goals.

Concerns over energy security lie at the heart of Japan’s domestic energy challenge, yet policy makers have yet to grasp the benefits of renewable energy for Japan’s economy and energy system. Japan’s dependence on imported energy (over 90% of Primary Energy in 2015 ) increased following the Great East Japan Earthquake which resulted in the suspension of its nuclear fleet. This import dependence not only exposes it to the market dynamics of growing energy demand within the region but also increases Japan’s vulnerability to potential supply side shocks due to increased climate change impacts.

In short, the Strategic Energy Plan seeks to procure energy security through a mix of imported fossil fuels, domestic nuclear generation and only tiny roles for wind and solar energy. This would be an energy strategy of the past not the future. It would inhibit Japan’s climate ambition and further act to consign its climate leadership to a historical reference to the Kyoto Protocol over 20 years ago. Worse still, the technical skill and manufacturing prowess of the world’s third largest economy will remain misaligned with the climate crisis that we face, lengthening the odds of achieving climate goals and putting Japanese companies at a disadvantage.

While Japanese investors in fossil fuel related businesses may not see any policy risks at the moment, the drastic cost decline of renewables is very likely to affect their business. In terms of the levelised cost of electricity (LCOE), BNEF estimates that for Japan a new utility scale solar PV will be cheaper than combined cycle gas turbines in less than five years and cheaper than coal in 2024. The best new onshore wind projects will be cost competitive with new coal before 2030, even in the absence of a carbon price.

Japan’s international export of coal technology

To compound these failings in its domestic energy policy, Japan continues to proactively export its mistaken approach to coal which risks locking in emerging economies to a future of stranded high carbon assets.

This was highlighted recently by Japan’s decision to support the Vietnamese Nghi Son II coal fired power plant, suspected to be in breach of OECD rules governing the sector, and completely at odds with the solar investment boom in Vietnam kicked off by last year’s newly agreed power purchase agreement.

Japan is also unique in placing an outside bet on hydrogen as a low-carbon energy source while planning to produce it using the most carbon-intensive fuel: lignite. Despite weak sales of the Toyota Mirai fuel cell vehicle, Japan has announced plans for 80 hydrogen fueling stations by 2022 and agreed a bilateral supply deal for the fuel from Australia. This would supposedly gasify brown coal (lignite) from the Latrobe Valley to create hydrogen for export. Yet serious uncertainties surround the potential deployment of carbon capture and storage at scale in Australia, which would be required in order to mitigate the resulting CO2 emissions from hydrogen production. On the contrary, Australia has been identified as one of the regions with the highest potential in the world to produce industrial hydrogen from renewable energy. Green hydrogen from renewable energy can play an important role in a transition of energy systems including industry and transport sectors to zero emissions (see Climate Analytics report on Western Australia’s gas and the Climate Action Tracker’s decarbonisation memos), and can already be produced at much less cost than hydrogen from brown coal with some projects being planned or built in South Australia – a region leading globally on integrating high shares of renewable energy.

In Japan, the economy is supposed to be top priority, with an elevated role for business – and the Keidanren (Japan’s Business Federation) certainly exerts great influence on both domestic policy and Japan’s export-led commercial diplomacy and geopolitical competition with near China.

But in many ways, the failure of Japanese energy policy reflects a wider failure of business strategy driven by historical views on geopolitical competition. Japanese industry continues to lose competitiveness to Chinese competitors that are embracing renewables at the same time as they are under cutting Japan’s coal power plant technology at cheaper prices through China’s geopolitical play of the Belt and Road Initiative.

Japanese power utilities and technology vendors are still trying to push yesterday’s coal technology and centralized energy systems into new markets, especially in the emerging economies of South East Asia but also looking further afield to Africa. This bolsters their continued pursuit of new domestic coal power plants and is supported by concessionary finance from the Japan Bank for International Cooperation and the Japan International Cooperation Agency.

This is the wrong technology choice for Japan and the world. Building more coal power plants is no longer compatible with any credible analysis of what is required to implement the Paris Agreement. Even supposedly ‘high efficiency’ plants deliver marginal emission reductions per unit of electricity generated but would result in high lifetime emissions of CO2. Japan’s policy makers and technology companies have failed to act on this crucial difference between efficiency and emissions.

But even beyond the climate implications of coal, Japan’s pursuit of coal technology exports is poor economics and bad business strategy. There is no route to economic success from trying to build coal plants cheaper than China, producing hydrogen from imported coal, or by offering ever more finance that ties in emerging economies and imposes growing risks on Japanese citizens.

Instead, a new diversification strategy to a renewable electricity production mix and smart grids is urgently needed. Japan needs to offer a technology partnership for the future, not the past. Internationally, Japan should move to fully and immediately implement the OECD arrangements, ceasing support for non-compliant projects and committing to the highest level of scrutiny for any proposed public investment in coal technology. No new projects should be admitted for consideration, ensuring that there would be an end to financial support for coal before 2020.

A new strategy for renewables deployment

However, there have been encouraging signs. Daiichi Life Insurance, the second largest insurance company in Japan announced that they would divest from project financing for new international coal fired power plant. The largest Japanese insurance company, Nippon Life Insurance has also announced that it will consider a similar policy. In addition, recent announcements are clear examples of the increasing risks of coal investments in Japan – most notably the two J-Power Takasago coal fired generation units planned in Hyogo Prefacture (1200MW) have been cancelled.

Recent cases of investors withdrawing from coal projects in Japan highlight the risks of stranded assets and difficulty in recouping investments. Many Japanese businesses and investors also face financial risks as the world’s major insurance companies, like AXA and Allianz, begin to divest from companies with coal interests . As international companies, like Apple, commit to 100% renewable targets, suppliers are increasingly coming under pressure to procure renewable energy and reduce emissions.

Following this trend, Japan should undertake a comprehensive revision to its Strategic Energy Plan, realistically and boldly reappraising a diminished future for nuclear and embrace analysis which shows that 10% of electricity from nuclear in 2030 is more realistic than the current assumption of 22%. Such a move becomes more possible politically as a result of the recent weakening of the position of Prime Minister Abe, who is a strong nuclear proponent.

The Plan should set an ambitious renewable energy target at its heart, increasing 2030 ambition from 24% to at least 35% in line with the recommendations of the recent Foreign Ministry taskforce. A bold renewable strategy is then needed to drive investment in domestic renewable energy technology and promote innovation around the next generation of renewable energy technologies e.g. including thin film and sprayable perovskite solar cells, floating offshore wind and utility-scale battery storage, each of which can hope to capture a growing multi-trillion dollar market .

To secure a clean energy transition, Japan’s policy makers need to revise their targets and policies to be consistent with international and national commitments and introduce measures – such as carbon pricing – to offer the right incentives to choose renewables over new coal and phase out operating coal plants. This would allow Japan’s economy to take advantage of opportunities for growth through additional future-proof investments into modern, clean, renewable technologies.

A sunset for coal

By taking a more realistic approach to the future of nuclear and embracing the growth opportunities for renewables, Japan’s policy makers can also signal that coal is on the way out. The new Strategic Energy Plan needs to send a clear signal to investors by reconsidering the role of coal in the electricity mix. Its new vision should align national targets with international commitments on emissions reductions and Japan’s interest in achieving the goals of the Paris Agreement. Additional coal plants are completely inconsistent with the Paris Agreement and the discussion should now be on how to phase out existing coal-fired power plants in an orderly manner.

Japanese policy makers should begin this realignment by announcing an immediate moratorium on new coal plant approvals and constructions. This should be accompanied by an urgent and rapid review of the objectives of the Strategic Energy Plan with the aim of establishing a firm target for the scale up of renewable generation and the phase out of coal by 2030 – thereby providing a sunset for coal and a new dawn for renewables. In doing so, Japan’s policy makers need to embrace the global shift to higher levels of renewable energy generation on the grid and move away from the old orthodoxy of coal and nuclear acting as traditional baseload generation.

Through this approach, Japan’s new Strategic Energy Plan can become the cornerstone for a move to upgrade its currently unambitious Nationally Determined Contribution (NDC), which is required under the Paris Agreement and its enabling decisions by 2020. The move towards a Paris Agreement compatible energy strategy could be the central piece of Japan’s G20 Presidency in 2019. This sunset date for coal, alongside a reappraisal of the role of nuclear and a resurgence in renewables, will allow Japan to regain its coveted climate leadership and support the push for greater ambition in 2020.

This is where engagement with the Powering Past Coal Alliance can help in terms of sharing real policy experience on the energy transition from coal. Many Alliance members committed to the phase out of coal are driving forward national processes to enable their transition. For example, the Netherlands is accelerating its transition move from coal in response to public pressure over its climate performance, recently announcing legislation to force its remaining coal power plants to cease operations by 2025 and 2030, with even this later date meaning that its most modern coal plants will operate for less than 15 years from original commissioning . Alliance members can offer invaluable assistance, experience and support to Japan as it seeks to take a new path.