Active

Climate change risk analysis to support the Network for Greening the Financial System

Contacts

Funder

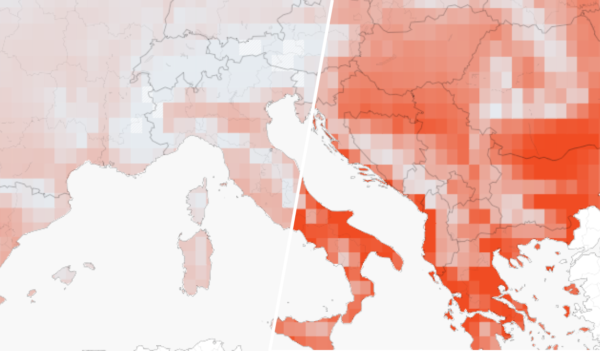

The NGFS network consists of more than 90 central banks and financial market supervisors, collaborating with scientific experts to better integrate the impacts of climate change into financial risk assessments. As a part of this work, the network release and update their own set of scenarios to provide a common and up-to-date reference point for understanding how climate change impacts (physical risk) and climate policy and technology trends (transition risk) could evolve in different futures.

The scenarios outlining three possible pathways: an organised transition, a delayed transition, and a failure in climate policy, and ultimately show the benefits of early reductions in greenhouse gas emissions, which can effectively minimise both physical and financial risks. Conversely, postponing action or taking no action would inevitably lead to increased costs in the medium to long term. This analysis offers detailed insights at a sectoral and regional level, aiding financial institutions in adjusting their investment strategies to adapt to the changing landscape.

Within the NGFS and in close collaboration with project partners, Climate Analytics provides acute physical climate risk indicators and projected changes in impacts under different climate scenarios. We also established and maintain the Climate Impact Explorer, an interactive online tool which allows users to explore and assess climate risks by country.