Climate Action Tracker: It only takes a few countries to kick-start energy system decarbonisation

Share

(2-page summary / infographic / policy summary technical report)

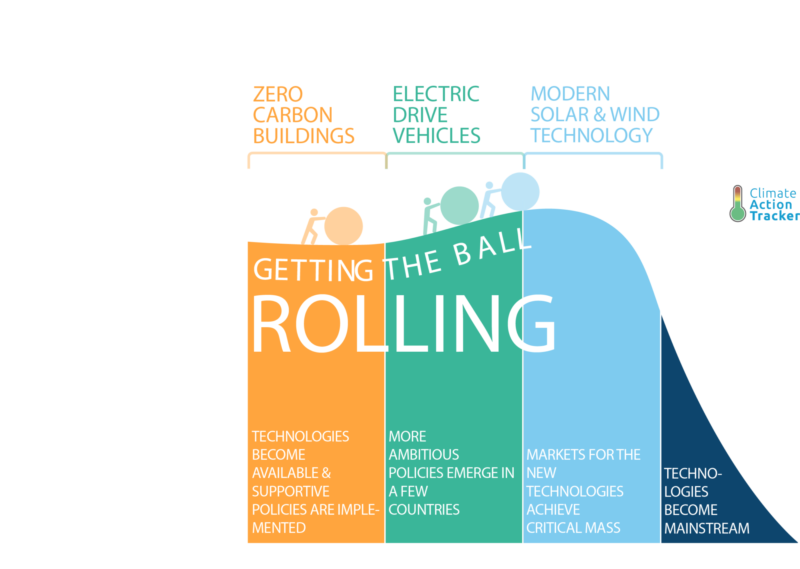

The global rise of renewable energy, which accounted for over half of all new electricity installations in 2015, was a result of strong actions by just a few countries, according to “Faster & Cleaner 2: kick-starting global decarbonisation,” released by the Climate Action Tracker and the ClimateWorks Foundation today.

The report based its investigation on the fact that to meet the Paris Agreement’s long-term temperature limit, and the global energy system must completely decarbonise by mid-century.

The Climate Action Tracker examined the trends driving decarbonisation in three key sectors of the global energy system: power, transportation, and buildings—and looked at what can drive rapid transitions in these areas.

“Germany, Denmark, and Spain introduced strong policy packages to encourage renewable energy, providing signals to investors and developers to invest in the new technologies. Next came the UK and Italy, and then China, whose bulk manufacture—especially in solar technology—provided economies of scale,” said Markus Hagemann, of NewClimate Institute and lead author of the report.

Between 2006 and 2015 installed wind power capacity increased by 600 percent, and solar energy capacity increased by 3500 percent. By 2030, solar PV is projected to become the cheapest energy generation source in most countries.

“There is still a long way to go toward total decarbonisation, but the power sector has picked up huge momentum,” said Hagemann.

“The policy packages of early movers included strong financial support schemes such as feed-in tariffs as well as mid to long term renewable energy targets. These gave certainty to investors and triggered the massive growth and price drops we see today. This initiated the wide spread application of such instruments where, by 2015, 146 countries had implemented such support schemes,” said Andrzej Ancygier, of Climate Analytics.

The report finds a similar trend is beginning in the transport sector, with the production of electric drive vehicles, which exceeded one million sales in 2016. New sales continue to exceed prior projections from only a few years ago.

“The same formula can be applied to electric cars—while they have further to go than renewable energy, all the signs are there for the decarbonisation of this sector to take off. Again, we find this change was started by just a few key players, this time Norway, the Netherlands, California and, more recently, China,” said Sebastian Sterl, of NewClimate Institute.

The type of successful policy packages that kick-started the sector often include a focus on targets for takeup, campaigns on behavioural change, infrastructure investment—especially important for electric vehicles—and research and development.

The final sector studied in the report is buildings, which is lagging behind the other two sectors.

“With the building sector, there are proven technological solutions that can result in new, zero-carbon buildings. Innovative financial mechanisms to increase the rate of retrofitting buildings, as well as good examples of building codes for new builds, would drive adoption of these technologies,” said Yvonne Deng of Ecofys, a Navigant company.

The report makes a number of recommendations as to how decarbonisation in those sectors can meet the Paris Agreement challenge, such as increasing flexibility in power systems to integrate larger shares of renewable energy, and more countries adopting policies in the electric vehicle market and on building standards.